10 Worst Stock Market Crashes Ever Witnessed in the History

You must have heard of stock market crashes in the past. The outcome of such a crash sometimes results in the loss of paper wealth and entire savings.

While some people earn a hefty amount of money dealing in stock markets, others become bankrupt. Sometimes investing in a stock market is a game of luck. For instance, some turn into millionaires, others have to sell their household and assets for their survival.

Here are a few worst stock market crashes ever noted.

1. Bengal Bubble of 1769

The Bengal Bubble was caused by the increasing overvaluation of the East India Company stock between 1757 and 1769. This crash terminated British control over India. It bankrupted the East India Company through the overvaluation of business enterprise.

This resulted in the Great East Indian Crash of 1769. The Bubble and crash occurred during the conquest of Bengal by the East India Company and increased powers in Bengal through the installation of the puppet regime of Mir Jafar.

In 1750, the company employed over 3000 troops. To control its possessions: this number had increased to 26000 by 1763 and then to 67000 by 1768. After the attacks by the Sultan of the Kingdom of Mysore and public revelations regarding atrocities committed by the company, stock values depreciated. By 1784, stock in the East India Company had dropped in value, causing a crash in the textile industry.

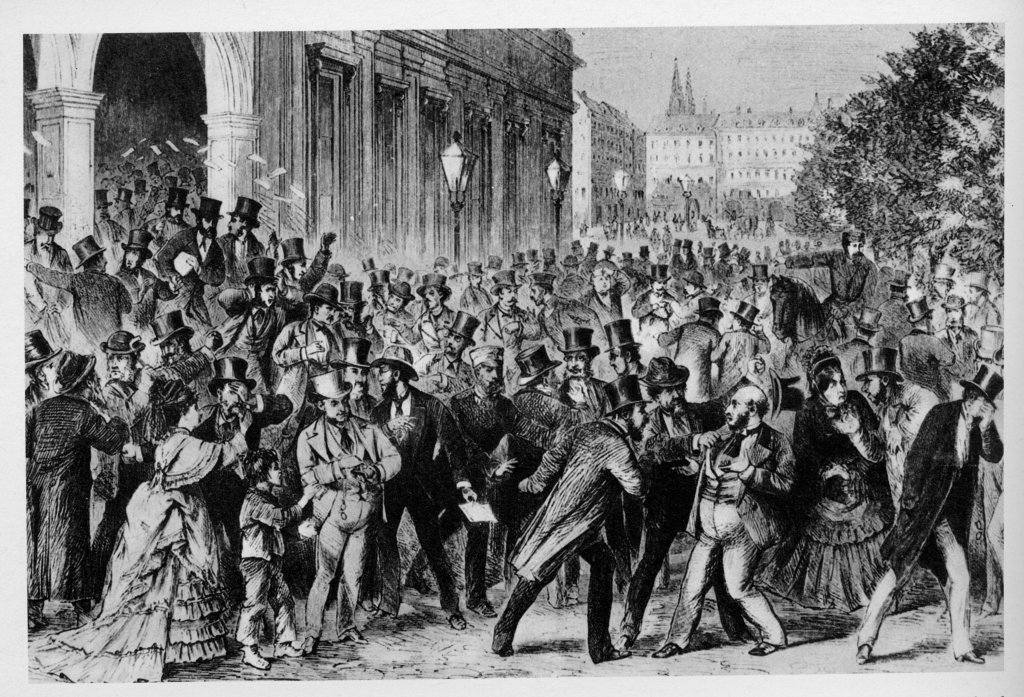

2. Panic of 1873

It was a financial crisis that caused an economic depression in North America and Europe that lasted from 1873 to 1877. In Britain, the panic that started weakened the country’s economic leadership. The panic was known as the Great Depression. The symptoms of the crisis were financial failures in Vienna.

The Panic of 1873 happened during the time of the Freedman’s Bank. The panic started with a problem in Europe when the stock market went down. During this time, the investors sold their investments, which they had in American projects, especially in Railroads.

When Europeans sold their railroad bonds, there were more bonds for sale than anyone wanted. Several railroad companies could not find someone who could lend them cash. Therefore, railroad companies went bankrupt. The panic spread to banks in New York, Georgia, Ohio, and other banks.

The failure of a bank started a chain of bank failures and closed the New York stock exchange. The effects of panic were felt in New York and other places.

3. Wall Street Crash of 1929

The Wall Street Crash, or better known as the Great Crash, was the American stock market crash that occurred in 1929. The crash started in September and ended in October when share prices on NYSE collapsed. It was one of the worst stock market crashes in history. The crash followed the London Stock Exchange’s crash of September. During this crash, billions of dollars were lost, and thousands of investors vanished.

After this, several countries, including America and others, went into depression. During the 1920s, the stock market underwent an expansion and reached its peak in 1929. By then, unemployment had risen and left stocks in great excess of their real value. Stock prices began to decline in September, and in October, the fall began.

Several investment companies and bankers attempted to stabilize the market by purchasing blocks of stock. On Monday, the market went into free fall. Monday was followed by Black Tuesday, in which the stock prices collapsed, and shares were traded on NYSE in a single day. The machines could not handle the huge volume of trading.

4. Japanese Asset of Price Bubble

The Japanese Asset Price Bubble was the economic bubble in Japan from 1986 to 1991 in which stock prices and real estate were inflated. The bubble was recognized by the acceleration of asset prices, overheated economic activity, and uncontrolled money supply. This worst stock market crash contributed to the Lost Decade, a 10-year collapse of the Japanese economy. By 1990, the Nikkei Stock Index reached its peak.

However, in 1991, the prices began to fall. The asset prices collapsed by 1992, and the economy’s decline continued for over a decade. The decline caused difficulties for several financial institutions. According to research, the increase in Japanese asset prices was due to delayed action by the BOJ to address the issue.

By the end of August, the BOJ indicated the possibility of tightening the monetary policy but then delayed the decision due to economic uncertainty. Later, it hinted at the possibility of tightening the policy due to pressures within the domestic economy.

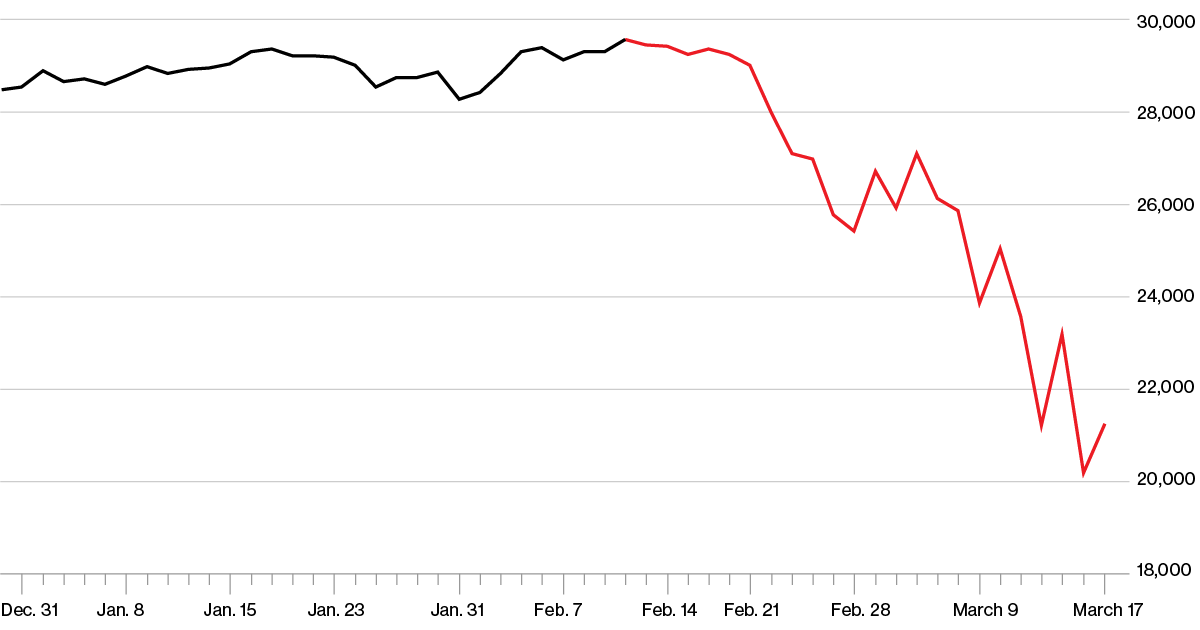

5. Stock Market Downturn of 2002

In 2001, stock prices took a downturn across the United States, Asia, and Europe. After recovering from lows reached following the 2011 attacks, the stock market index fell continually in March 2002 and declined in July and September. It resulted in lows last reached in 1997 and 1998.

This downturn hit several countries and can be viewed as a part of the bear market or correction that began in 2000 after a bull market led to unusually high stock valuations. Many popular internet companies, including Exodus Communications, Pets, and more, went bankrupt.

Other companies like Amazon and eBay went down in value. The outbreak of accounting scandals was also the major factor in the fall. The International Monetary Fund expressed concern about instability in the United States markets and also about the downturn.

As of September 2002, the Dow Jones Industrial Average had lost nearly 27% of its value it held in January 2001. It lost 9% of its peak value at the beginning of 2001, and Nasdaq had lost 44%. The total market value of NYSE and NASDAQ companies at the time was $9 trillion, for the market loss of over $9.3 trillion.

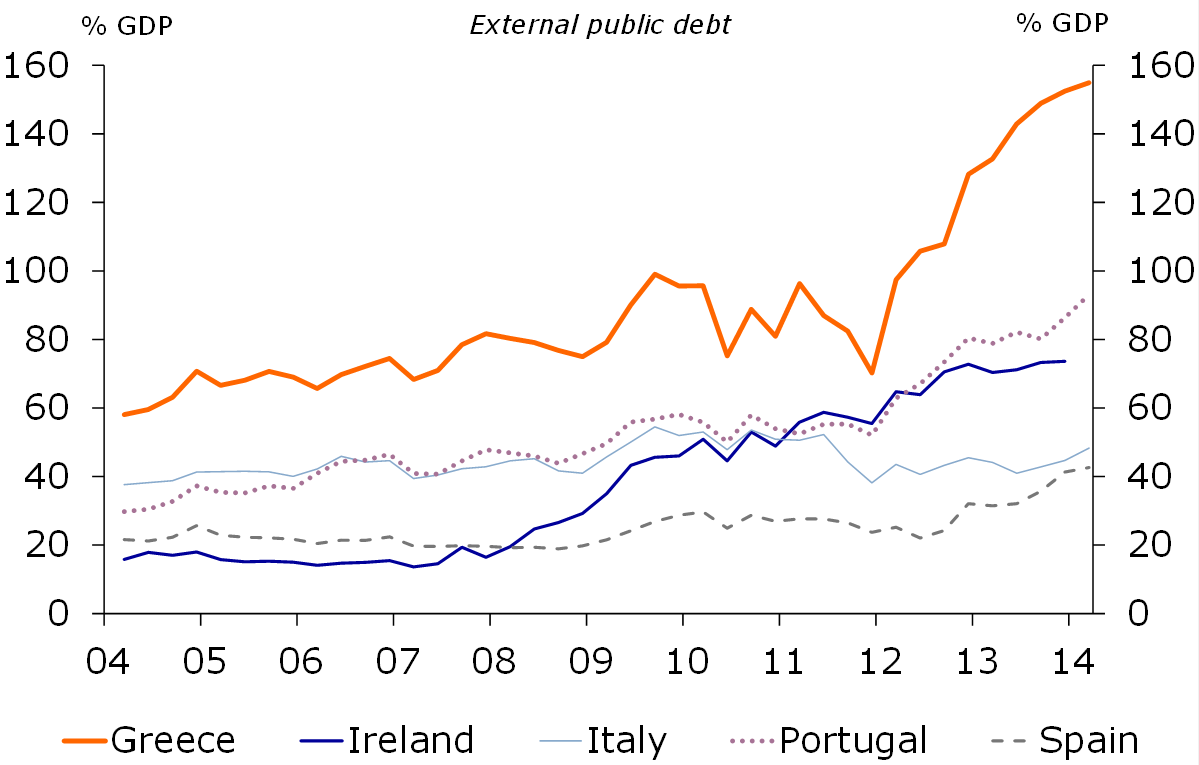

6. Eurozone Debt Crisis

The European Debt Crisis, or better known as Eurozone Crisis, is a multi-year debt crisis that has been taking place in the European Union since the end of 2009. Eurozone members like Ireland, Spain, and Cyprus, were unable to repay their government debt.

This worst stock market crash was caused by the balance of payment crisis. The crisis had the worst economic effects and market effects and was blamed for economic growth for the entire EU.

The handling of the crisis has led to several national governments and influenced the outcome of several elections. According to the Organization for Economic Cooperation and Development, the Eurozone crisis was the world’s greatest threat in 2011 and 2012.

The crisis started in 2009 when the world realized that Greece could default on its debt. The European Central Bank adopted an interest that encouraged investors in Northern Eurozone members to lend to the South. The crisis resulted from the structural problem of the Eurozone and other factors, like easy credit conditions and globalization of finance.

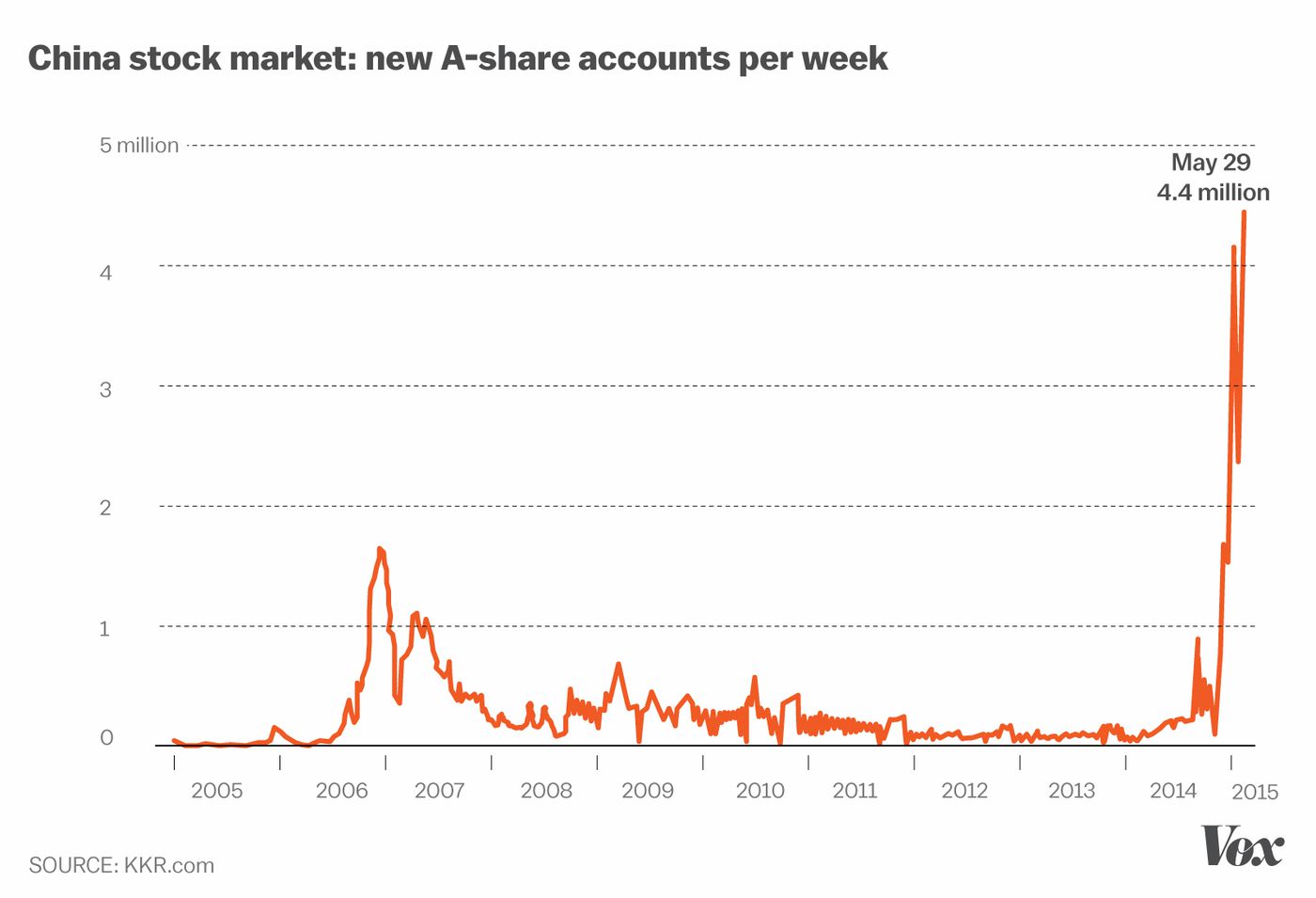

7. Chinese Stock Market Turbulence

This began in June 2015 and ended in February 2016. During this time, the Chinese stock markets like Shanghai Stock Market fell as several companies filed for a trading halt in the attempt to prevent further loss.

A third of the value of A-shares of the Shanghai Stock Exchange was lost within one month of the event. Some shocks occurred in July and August’s Black Monday. The turbulence is believed to have been an integral part of China’s shifting from manufacturing to service industries.

In October 2015 International Monetary Fund annual meeting of finance ministers and central bankers from the Washington-based lender’s 188 member-countries "held in Peru, China's slump dominated discussions with participants asking if "China’s economic downturn [would] trigger a new financial crisis." By the end of 2015, China’s market outperformed S & P for 2015.

Also, at this time, the Shanghai Composite Index was up by 12.6%. In 2016, the Chinese stock market experienced a sell-off, and trading was halted on 4 and 7 January 2016. According to Xinhua News Agency, the press Agency of the People’s Republic of China, China reported a 7% GDP growth rate for 2015 and an economic value of over ten trillion US dollars. After January 2017, the China market is stable.

8. 1998 Russian Financial Crisis

Russian Financial Crisis, also known as Russian Blue, was a crisis that hit in 1998. It resulted in the Russian government and the Russian Central Bank devaluing the Ruble (currency of Russia). The crisis had major impacts on the economies of several countries. Russia inflation reached 84% in 1998, and welfare costs grew. Several Russian banks, including Inkombank and Oneximbank, were closed.

In 1998, coal miners went on strike over unpaid wages and blocked Trans-Siberian Railway. By August, there was $12.5 billion in debt owed to Russian workers. Also, Bankers’ trust suffered a loss in 1998 due to the bank having a large position in Russian government bonds. Russian bounced in August 1998 with speed. The reason for the recovery is that world oil prices increased during 2000, and Russia ran a trade surplus in 2000.

9. Encilhamento

The Encilhamento was the worst stock market crash that occurred in the late 1880s and 1890s in Brazil. The policy of economic incentives created speculation and increased inflation and thus encouraged fraudulent initial public offerings and takeovers.

Throughout the 19th century, technological innovations, especially the development of gas and steamships, all linked to the process of industrialization offered opportunities and led to an acceleration of the flow of capital in the world.

The finance minister adopted a policy of unrestricted credit for industrial investments, backed by the issuance of money to encourage Brazil’s industrialization.

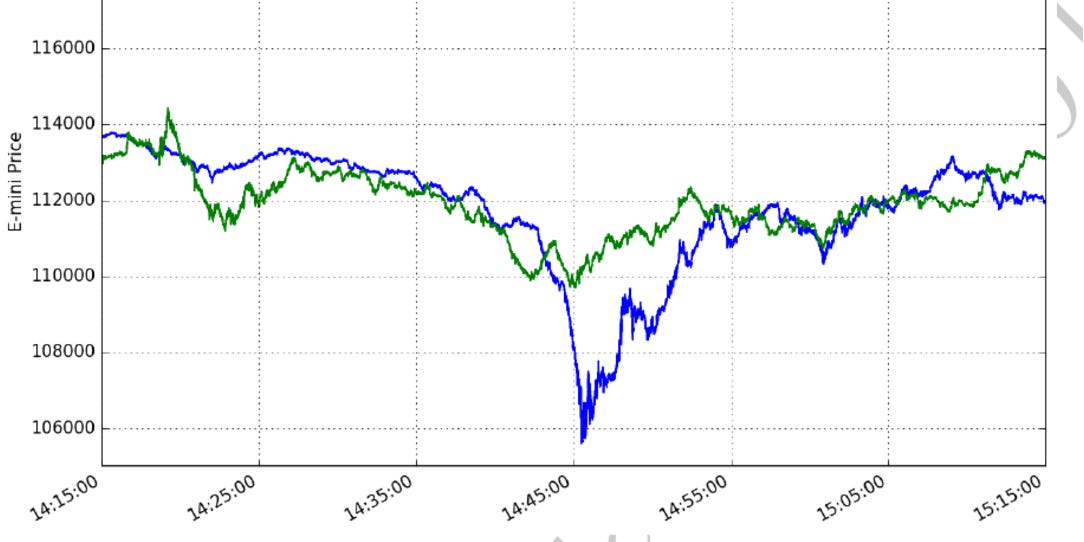

10. 2010 Flash Crash

The 2010 Flash Crash was the worst stock market crash noted on 6th May 2010. The crash lasted for over 30 minutes. Stock indexes like S & P 500 and Nasdaq were collapsed and rebounded during the crash.

The industrial Average had its point drop on that day and is described as the most turbulent period in the history of financial markets. In 2015, after five years of the crash, the US Department of Justice laid criminal counts, including market manipulation.

Final Words

Be it a manufacturing industry or stock market insights: every business can fluctuate at any time. Have you experienced a stock market crash? How much did you lose? How did you bounce back? Share your comments below.

Popular Posts

Itchy Feet Superstition: Truth Behind The Notion

Human body has been subject to various superstitions since centuries. The beliefs have passed down from generation to generation...

Bharat Asrani

15 Facts About Mermaids That You Were Not Aware About

Nearly three quarters of the Earth is covered with water. No wonder, oceans contained various mysterious creatures like mermaids...

Swati Bhandari

15 Things About Fluffy Cow That Internet Did Not Tell You

Have you heard about the fluffy cow? Well, it is the beefy, fluffy & adorable cattle pampered and groomed more than average and also went crazy viral on the internet.

Swati Bhandari