Follow These 5 Golden Money Rules and Save Bigger for Future

Here are a few simple tricks on how to save money. Follow these money rules and become a millionaire. Know how to be more wealthy.

You must have heard about the phrase that Money can buy happiness. It is true, without money, you can’t live the life of your dreams. While most of us are busy doing a 9-5 job to survive, others are happy with their paychecks and credit card score. Also, some are busy balancing their professional and private life and saving enough for the next mid-day meal.

You might not know anyone, but several people work as much as we do, and are living a better lifestyle than yours. They have enough savings and are wealthier. Do you know how? They are good at managing money and follow certain money rules.

Do you also want to become rich? Yes, then follow these tricks and tips and make your lifestyle better.

1. Want vs. Need

Before you make a list of things you want to buy from the market, take time, and ask yourself how passionate you are about that thing. Do not make an expensive purchase if there’s not an emergency.

For instance, you like the jeans that you saw at the store. But there’s no need for it, as you already own a couple of jeans. So better you don’t buy it and save cash by doing so. Ask yourself about your wants and needs and do not spend much.

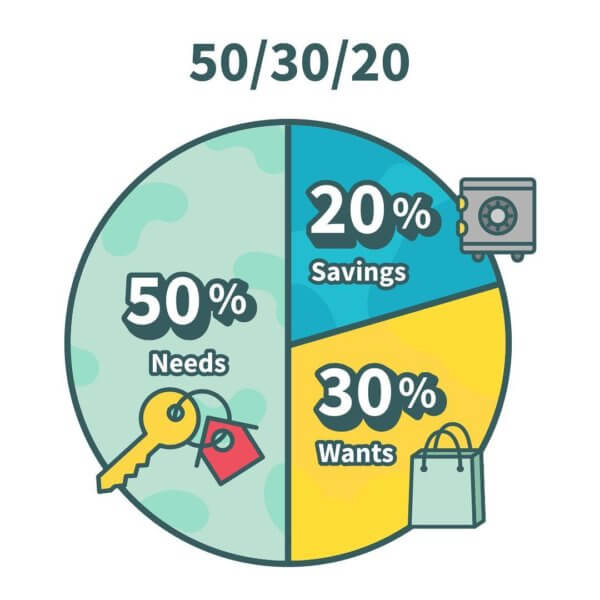

2. 50-30-20 Method

This is the golden rule for savings. Set a budget and follow it. Follow this 50-30-20 method and save money for the future. For instance, if you earn 50k. Spend 50% of it on the things that are important (groceries, electricity bills, and more), 30% on shopping and traveling, and save 20% for emergency and other things like medical insurance.

3. Do Shopping During Sale

Who doesn’t love shopping? But buying things that are not on sale doesn’t save anything. Buy things that are your priority and leave other things for sale. Plan your shopping list, and buy them when they are on sale. You could also bargain if you are good at it. You could save $1 for the first week, $2 for the second week, and so on. Alternatively, you could also start no spending weeks or days.

You would be surprised to know that you have saved over $1000 in a year. Plan a trip to your favorite destination with the savings. Follow these travel hacks to save more for your next trip (you can thank us later!).

4. Repair Things Before Throwing Them

Do you know what most rich people do? They love shopping, but also promote the idea of repairing gadgets and things before throwing them. Seeking out a cobbler would save you big, and not purchasing new shoes.

So, before you buy anything online or from the store, check if it could be repaired. This way, you could save extra for the next purchase. If you are a frequent online shopper, then these online shopping hacks could save you huge money.

5. Invest in Yourself

The best investment that you could make is to invest in yourself. Take an online course, get a certification, and spend money on other hobbies that could give you back in the future.

Explore new ideas that could give you extra income. Remember, the more you would invest in yourself, the more you would become valuable.

Final Words

Managing money looks like a full-time job. But it is not as difficult as you think. If you work 9-5 and are looking for other interesting jobs that could help make money, then become a Netflix tagger or a photographer and sell photos. Don’t forget that money doesn’t determine your happiness.

Think for a moment, and you will know that it’s the inner you who could decide what things are important and what could be avoided. You don’t need to own everything in this world. It needs patience and an understanding of how you could save more. Ask experts and save enough for your retirement.

The goal of life should be to become happy and not to chase money. Money can indeed buy you everything, but it can’t buy happiness. It could help you at the time of need, but it can’t love you back.

Do you know other money rules that saved you at the time of crisis? If yes, then don’t forget to share them with us.

Popular Posts

20 Most Powerful Goddess Names In Mythological World

From Gaia to Kali; every goddess in mythologies have a prominent role to create or restore the balance in nature and the universe.

Kimberly Campbell

21 Gods & Goddesses of Destruction, Death & Underworld

This list showcases the Gods of death, the Underworld, and destruction: from the Egyptian God of Death- Anubis, who was recognized as a man with a jackal head, to the Hindu God of Death- “Yama,” who took the records of each person’s death. But Thanatos was the personified spirit of non-violent death.

Rupesh Chhabra

14 of the Renowned Gods and Goddess of Healing & Medicine

No wonder, the God of healing and magical tradition allied to it, never failed to surprise people especially in ancient times. Let’s discover some of God and Goddess of healing and their amazing contribution.

Rupesh Chhabra